Crucial Insights

-

Important management in excess of Platinum Expenditure Administration by retail traders implies that the normal general public has much more energy to influence management and governance-related selections

-

50% of the organization is held by the top rated 13 shareholders

To get a feeling of who is truly in management of Platinum Expenditure Administration Constrained (ASX:PTM), it is vital to recognize the possession construction of the company. And the group that retains the most significant piece of the pie are retail investors with 47% possession. In other words, the team stands to gain the most (or lose the most) from their investment into the organization.

Specific insiders, on the other hand, account for 28% of the firm’s stockholders. Insiders generally individual a huge chunk of younger, smaller sized, organizations while big companies are likely to have establishments as shareholders.

In the chart underneath, we zoom in on the unique possession groups of Platinum Investment decision Administration.

Look at our hottest examination for Platinum Expense Administration

What Does The Institutional Ownership Notify Us About Platinum Expense Administration?

Numerous institutions measure their efficiency against an index that approximates the regional marketplace. So they ordinarily pay back more consideration to providers that are provided in big indices.

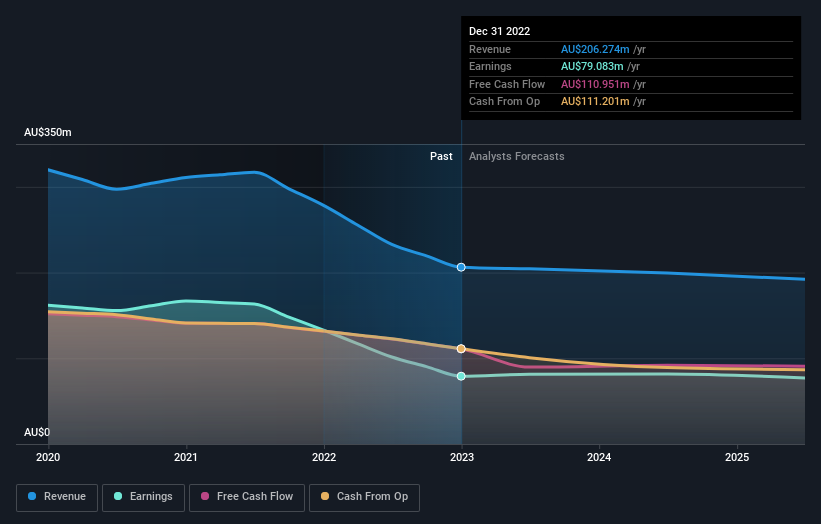

As you can see, institutional traders have a honest sum of stake in Platinum Expense Administration. This implies the analysts doing the job for those establishments have appeared at the inventory and they like it. But just like everyone else, they could be erroneous. When many institutions very own a inventory, there’s constantly a chance that they are in a ‘crowded trade’. When these kinds of a trade goes incorrect, several get-togethers could compete to market stock quickly. This threat is larger in a company without the need of a historical past of development. You can see Platinum Expenditure Management’s historic earnings and revenue underneath, but keep in intellect you will find constantly much more to the story.

It would appear that 5.6% of Platinum Financial commitment Administration shares are controlled by hedge money. That value noting, considering that hedge funds are often really energetic investors, who may possibly try to affect management. Lots of want to see worth development (and a greater share rate) in the limited phrase or medium phrase. Our facts reveals that William Kerr Neilson is the greatest shareholder with 22% of shares outstanding. For context, the next greatest shareholder retains about 5.7% of the shares fantastic, adopted by an possession of 5.6% by the third-major shareholder. Andrew Clifford, who is the second-premier shareholder, also comes about to hold the title of Chief Govt Officer.

Searching at the shareholder registry, we can see that 50% of the ownership is managed by the top rated 13 shareholders, which means that no single shareholder has a vast majority curiosity in the ownership.

Whilst learning institutional possession for a company can incorporate benefit to your investigation, it is also a excellent apply to investigation analyst suggestions to get a deeper have an understanding of of a stock’s predicted general performance. Rather a couple analysts address the stock, so you could seem into forecast progress fairly effortlessly.

Insider Possession Of Platinum Investment Administration

The definition of an insider can differ somewhat amongst different countries, but users of the board of administrators constantly depend. Administration in the end responses to the board. Nonetheless, it is not unusual for administrators to be govt board associates, in particular if they are a founder or the CEO.

I typically contemplate insider ownership to be a good matter. Nonetheless, on some occasions it makes it far more difficult for other shareholders to keep the board accountable for choices.

Our details implies that insiders sustain a important keeping in Platinum Investment Management Constrained. Insiders have a AU$274m stake in this AU$975m business. It is great to see insiders so invested in the business. It could be worth examining if all those insiders have been buying not too long ago.

Typical Public Ownership

The standard community– together with retail traders — own 47% stake in the corporation, and hence can’t simply be disregarded. When this team won’t be able to necessarily get in touch with the photographs, it can absolutely have a genuine influence on how the firm is operate.

Upcoming Techniques:

When it is properly worth considering the distinct groups that possess a company, there are other components that are even much more vital. Scenario in place: We have noticed 2 warning indicators for Platinum Financial commitment Administration you must be informed of, and 1 of them is relating to.

But in the long run it is the long term, not the previous, that will figure out how well the entrepreneurs of this small business will do. For that reason we imagine it a good idea to just take a search at this totally free report demonstrating whether analysts are predicting a brighter future.

NB: Figures in this report are calculated making use of facts from the past twelve months, which refer to the 12-month period ending on the very last day of the thirty day period the economical statement is dated. This could not be reliable with entire yr once-a-year report figures.

Have suggestions on this post? Involved about the written content? Get in touch with us directly. Alternatively, e mail editorial-crew (at) simplywallst.com.

This article by Just Wall St is basic in character. We supply commentary centered on historical facts and analyst forecasts only applying an impartial methodology and our content articles are not meant to be economical advice. It does not constitute a suggestion to invest in or sell any inventory, and does not choose account of your targets, or your economic problem. We purpose to deliver you extensive-phrase focused analysis pushed by basic knowledge. Note that our evaluation may perhaps not aspect in the most up-to-date price tag-sensitive business bulletins or qualitative materials. Merely Wall St has no place in any shares pointed out.

Sign up for A Compensated User Exploration Session

You will get a US$30 Amazon Present card for 1 hour of your time when helping us construct better investing applications for the specific buyers like your self. Sign up right here