Eoneren

Horizon Technological know-how Finance Corporation (NASDAQ:HRZN) is a perfectly-managed small business advancement firm specializing in technological innovation companies.

The portfolio is accomplishing perfectly, the dividend is effectively-lined, and the BDC not long ago greater its month-to-month dividend by 10%.

Horizon Engineering Finance, I feel, is an interesting BDC to contemplate for passive income investors, owing to its concentration on a industry niche.

The stock is trading at roughly reserve value, but it has the likely to broaden its high quality valuation if the Fed carries on to raise fascination prices in 2023.

Horizon Technological innovation Finance Operates In The Venture Cash Sector

Horizon Know-how Finance is unique from other business enterprise development firms in that it focuses on giving enterprise debt capital to increasing organizations.

Most BDCs commit in organizations in the center marketplace, which is made up of companies that have problems acquiring financing from conventional financial institutions. The the vast majority of middle-current market companies are set up, mature firms with extended operating histories and stable, economic downturn-resistant money flows.

Horizon Technological know-how Finance, on the other hand, focuses on the enterprise money market, with a unique emphasis on technological know-how, everyday living sciences, and healthcare engineering businesses.

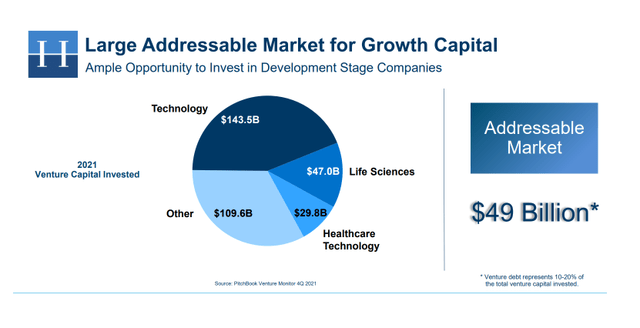

The whole addressable marketplace for this kind of financial investment tactic is $49 billion, and it is served by a compact variety of specialized BDCs this kind of as Horizon Technological know-how Finance and Hercules Capital, Inc. (HTGC).

Undertaking Money Investments (PitchBook Undertaking Keep an eye on 4Q 2021)

Horizon Technologies Finance’s portfolio is mostly comprised of credit card debt investments created to companies in a selection of industries, the the vast majority of which are biotechnology (24%), medical products (18%), consumer-linked technological know-how (18%), and program (17%).

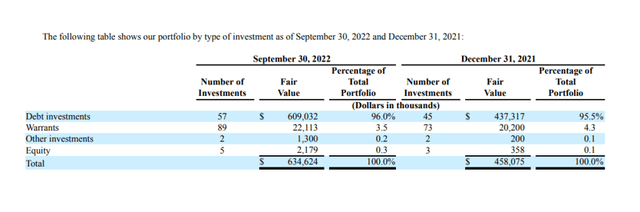

At the finish of the September quarter, credit card debt investments produced up 96% of the BDC’s portfolio, with warrants accounting for the remaining 3.5%.

Horizon Technology Finance gains further upside potential from warrant (but also fairness) investments if a certain borrower’s small business usually takes off.

As of September 30, 2022, the BDC’s investment portfolio was valued at $634.6 million. According to Horizon Technological know-how Finance’s most recent quarterly 10-Q report, there were no non-accrual investments.

Portfolio By Expense Sort (Horizon Know-how Finance Corp)

Dividend Coverage And Dividend Development

Horizon Engineering Finance gained $1.06 for every share in internet expenditure profits among January and September 2022, though shelling out out a whole of $.90 for each share. The quarterly dividend was $.30 for every share and was compensated on a month-to-month foundation all through 2022.

The fork out-out ratio for 2022 based mostly on the info readily available so much was 84.90%, indicating that the dividend is extremely effectively covered.

Since of its sturdy dividend coverage, the company introduced a 10% maximize in its every month dividend to $.11 for each share, giving investors who obtain HRZN currently a 10.9% dividend yield.

Horizon Technological know-how Finance also has portfolio profits upside from its floating fee investments. Horizon Technological innovation Finance’s outstanding principal volume of credit card debt investments experienced floating rate interest charges as of September 30, 2022, implying that a hawkish central lender in 2023 could consequence in expenditure revenue tailwinds for Horizon Technological innovation Finance.

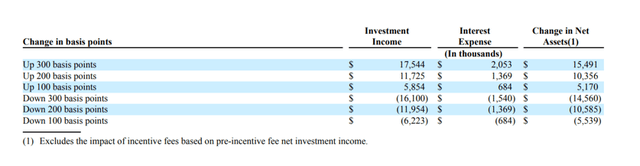

According to BDC projections, a 100-basis-place boost could result in $5.85 million extra investment cash flow and, probably, an raise in the base dividend or the payment of a specific dividend.

Improve In Basis Points (Horizon Technology Finance Corp)

Top quality Valuation Possible

Horizon Technological know-how Finance is investing at a 4% high quality to web asset value, which, in my belief, has the likely to mature into a larger high quality, in particular presented the BDC’s exceptional portfolio high-quality.

The BDC’s portfolio is performing effectively, and the floating rate investment decision publicity strongly implies portfolio earnings upside that buyers might not have totally factored into Horizon Technologies Finance’s valuation.

Hercules Money, for example, achieves a considerably higher web asset worth high quality, and Horizon Engineering Finance, in my belief, deserves a identical 30%+ NAV quality.

Why Horizon Technology Finance Could See A Lower/Better Valuation

Horizon Know-how Finance, I believe, has a much more interesting progress profile than other business enterprise advancement organizations due to the BDC’s key concentration on technological know-how providers.

Horizon Technological innovation Finance is comparable to Hercules Capital in that it has the identical goal current market and core investment decision concentration. In gentle of the BDC’s lengthy background of developing potent financial benefits, I strongly advise HTGC.

My Conclusion

Horizon Know-how Finance, in my opinion, is a effectively-managed company development business with prospective in the undertaking cash market as very well as upside in portfolio cash flow and valuation.

The BDC’s stock is at present trading about e book benefit, but I believe HRZN’s valuation quality will develop as long as the portfolio performs perfectly (no new non-accruals).

Specified that the BDC a short while ago elevated its dividend payout by 10%, I feel the 10.9% produce obtainable in this article is one that passive profits traders will be in a position to appreciate for quite some time.