Welcome to FT Asset Administration, our weekly e-newsletter on the movers and shakers behind a multitrillion-greenback world field. This article is an on-website model of the e-newsletter. Signal up right here to get it despatched straight to your inbox every Monday.

Does the format, information and tone operate for you? Enable me know: [email protected]

Inside of WorldQuant’s ‘Alpha Factory’

When Igor Tulchinsky was choosing no matter if to sign up for hedge fund Millennium Management 3 a long time in the past, the Belarusian previous online video match programmer eschewed the systematic, facts-driven strategy that is attribute of “quants” like him. He only flipped a coin.

It was not “so that likelihood shall make your mind up the affair, while you’re passively standing there moping”, to quote a poem by Danish scientist Piet Hein. “But the minute the penny is up in the air, you instantly know what you are hoping.”

The coin toss dictated that Tulchinsky must stay at his latest employer, choices trader Timber Hill. But when he declared the decision to Millennium, “I felt so poor,” he explained to me and my colleague Robin Wigglesworth in a uncommon job interview. So he changed his mind and give up Timber Hill for Millennium.

His about-face turned out effectively for Millennium’s buyers. Tulchinsky turned 1 of its leading portfolio professionals, and in 2007 spun out a quantitative investment manager, WorldQuant, to control funds for the now about $60bn-in-assets hedge fund team. Around the previous 15 yrs WorldQuant has grown into a person of the most significant and maximum-contributing models at a person of the world’s prime hedge money.

Its product is to make algorithms that consider to forecast the selling price actions of different economic devices, normally equities, and then choose gain of inefficiencies in the markets. Tulchinsky, whose intense gaze and head-to-toe black apparel give him the air of a James Bond villain, refers to these algorithms as “alphas” and to WorldQuant as the “Alpha Manufacturing facility.”

Really don’t skip the full tale of Tulchinsky’s unlikely career route, how WorldQuant is hoping to continue to be forward by diversifying into new locations like large-frequency investing and corporate bonds, and the company’s unusually decentralised world wide workforce.

Its places of work in 13 countries are spread throughout many non-regular economic centres, this sort of as Ramat Gan, Israel Budapest Mumbai Ho Chi Minh Metropolis and Seoul. The business enterprise is created on the premise that “talent is dispersed equally around the earth, prospect is not”, says Tulchinsky. “And we present prospect to the talent.”

A new golden age for short marketing?

Hedge fund brief sellers have rarely enjoyed the finest of periods through a ten years or a lot more of a seemingly under no circumstances-ending bull marketplace. This 12 months their luck at last seems to have improved.

The greatest identified tool of the hedge fund business, and one particular of its most controversial, limited selling is back in fashion, writes my colleague Laurence Fletcher. That is thanks to the close of what previous Soros Fund Administration investor Renaud Saleur, who now operates Geneva-centered hedge fund Anaconda Commit, phone calls the “fantasy” sector, or the “everything rally” that lifted equally fantastic and bad stocks with small differentiation in the course of the coronavirus pandemic.

This year’s enormous sell-off in the speculative technological know-how sector has presented a prosperity of options for administrators, with Goldman Sachs’ Unprofitable Tech index slipping 60 for each cent as growing desire fees make these types of companies’ upcoming income flows considerably considerably less interesting.

Another area of prospect has been the cryptocurrency sector, wherever bitcoin miners have grow to be the newest target. Lossmaking Marathon Electronic, for instance, is just one of the most shorted stocks in the US sector. The organization paid out its former chief executive approximately $220mn in stock awards past year but due to the fact has then fallen properly limited of its mining and profitability targets.

Hedge fund supervisors say that their shorts have been providing the finest returns in several years. But it remains a tough business navigating vicious bear sector rallies and growing inventory correlations. In the meantime “speculative technology” is no for a longer period the obvious short that it was at the begin of the year.

Short sellers manufactured millions for the duration of the dotcom bust two many years ago and all over again betting against the banking institutions throughout the 2007-08 monetary disaster. If the existing bear market place turns out to be anyplace close to as bad as Elliott Administration or Saba Money’s Boaz Weinstein have a short while ago predicted, then quick selling could be coming into a new golden age.

Chart of the 7 days

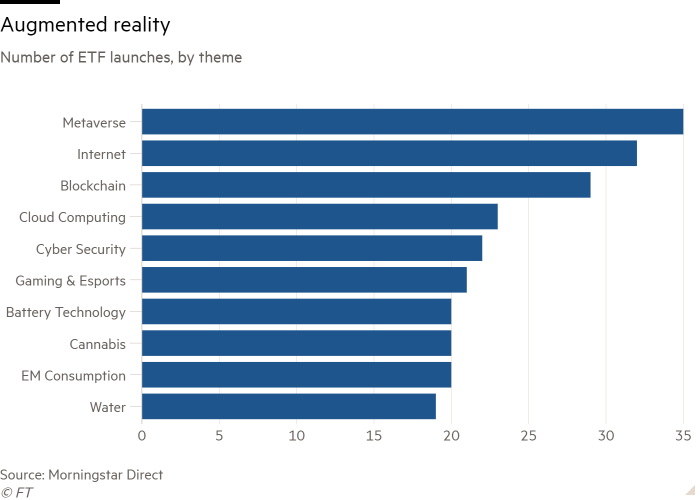

The metaverse has become the best notion at any time in the heritage of exchange traded money — inspite of continual media coverage suggesting there has been minimal desire in the “sub-theme”.

A whole of 35 metaverse-badged ETFs have launched globally considering that the to start with rolled off the conveyor belt in June 2021, in accordance to info from Morningstar, writes Steve Johnson.

This exceeds the selection for any other “sub theme”, according to Morningstar classifications, at any time, trumping the 32 for world wide web ETFs, 29 for blockchain types, 23 for cloud computing and 22 for cyber stability.

The avalanche of launches has occur despite an embarrassing absence of traction for many early choices in the metaverse — a futuristic immersive version of the world-wide-web enabled by digital and augmented fact.

Even Meta Platforms, which was so enamoured by the principle that it transformed its name from Facebook to “reflect its emphasis on creating the metaverse”, has started out to lay off personnel associated with the venture.

But when it arrives to ETFs, “we have found extremely, incredibly fast uptake”, said Kenneth Lamont, senior fund analyst for passive approaches at Morningstar. “It’s the quickest ever.”

10 unmissable stories this week

BlackRock has pulled in substantially extra funds from US retail traders than its rivals so considerably in 2022, in accordance to Morningstar information, even as the world’s major asset manager has appear underneath assault from the two the remaining and suitable around its strategy to sustainable investing.

Texas legislators have excused Vanguard from becoming grilled on its tactics at a listening to on environmental, social and governance investment variables, a week following the asset management big stop the major global money alliance on tackling weather transform.

The Fed requires to stop raising charges, writes Bill Gross, philanthropist and co-founder of Pimco. With way too substantially concealed leverage about, the central financial institution should really wait around to see if the punch bowl has been sufficiently drained.

The Securities and Trade Fee, the key US markets watchdog, has proposed the most sweeping overhaul of inventory trading in just about two a long time in an energy to improve rates and transparency for small buyers.

Ray Dalio and Hollywood film-maker James Cameron have bought an fairness stake in a submarine maker that makes it possible for the extremely-wealthy yachting class to take a look at the remotest elements of the world. The billionaire founder of Bridgewater Associates, the world’s major hedge fund, is now part-operator of Triton Submarines, a Florida-based company that specialises in submersibles for the super-prosperous.

A sea transform is less than way in markets, writes Howard Marks, co-founder and co-chair of Oaktree Money Management, in this feeling piece. The financial commitment environment may be encountering the third significant change of the past 50 years, which signifies that procedures that labored greatest this period of time may possibly not be the kinds that outperform in the years ahead.

Carlyle is struggling to raise the $22bn it had qualified for what it hopes will be its most significant fund, as it grapples with a succession disaster and a industry downturn. The US buyout team has questioned traders for an extension until finally the finish of August, following indicating it expected to miss out on its target to elevate $22bn by March 2023.

Muddy Waters has unveiled a brief situation against Vivion, a €4bn European house enterprise, accusing its major shareholders of utilizing “bond sale proceeds to unduly enrich themselves” and inflating the genuine price of their assets.

Billionaire investor Kenneth Griffin has sued the Interior Revenue Support and US Treasury division around the leak of his tax records to non-income media group ProPublica past yr. The Citadel hedge fund tycoon alleges IRS personnel were being able to “misappropriate” private tax information and facts and leak it since of a absence of safeguards at the governing administration company.

“Fraud in shorts and T-shirts”: the situation towards the FTX founder. Sam Bankman-Fried’s arrest in the Bahamas exposes revenue transfers prior to collapse of crypto empire.

And eventually

Casablanca has returned to the cinemas for its 80th anniversary, a prospect to see for the initially time on the significant display screen the fantastic romance among Humphrey Bogart and Ingrid Bergman. The golden age classic continues to be difficult to resist.

Wishing you all a incredibly satisfied Christmas. We’ll be back again on December 27 with a exclusive 12 months-conclusion edition of FT Asset Management, Harriet

Many thanks for reading through. If you have mates or colleagues who may well take pleasure in this publication, you should ahead it to them. Signal up right here

We would really like to listen to your feedback and comments about this newsletter. Email me at [email protected]

Advised newsletters for you

Owing Diligence — Top rated tales from the earth of company finance. Signal up in this article

The 7 days In advance — Begin each and every 7 days with a preview of what’s on the agenda. Signal up below